michigan sales tax exemption for manufacturing

Is manufacturing equipment tax exempt. Michigan Sales and Use Tax Certificate of Exemption Then please mail the form to.

See Notice of New Sales and Use Tax Requirements.

. However the Manufacturing Research and Development partial exemption is only in effect until June 30 2030. The Acts also identified a replacement specific tax on personal. For transactions occurring on or after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan.

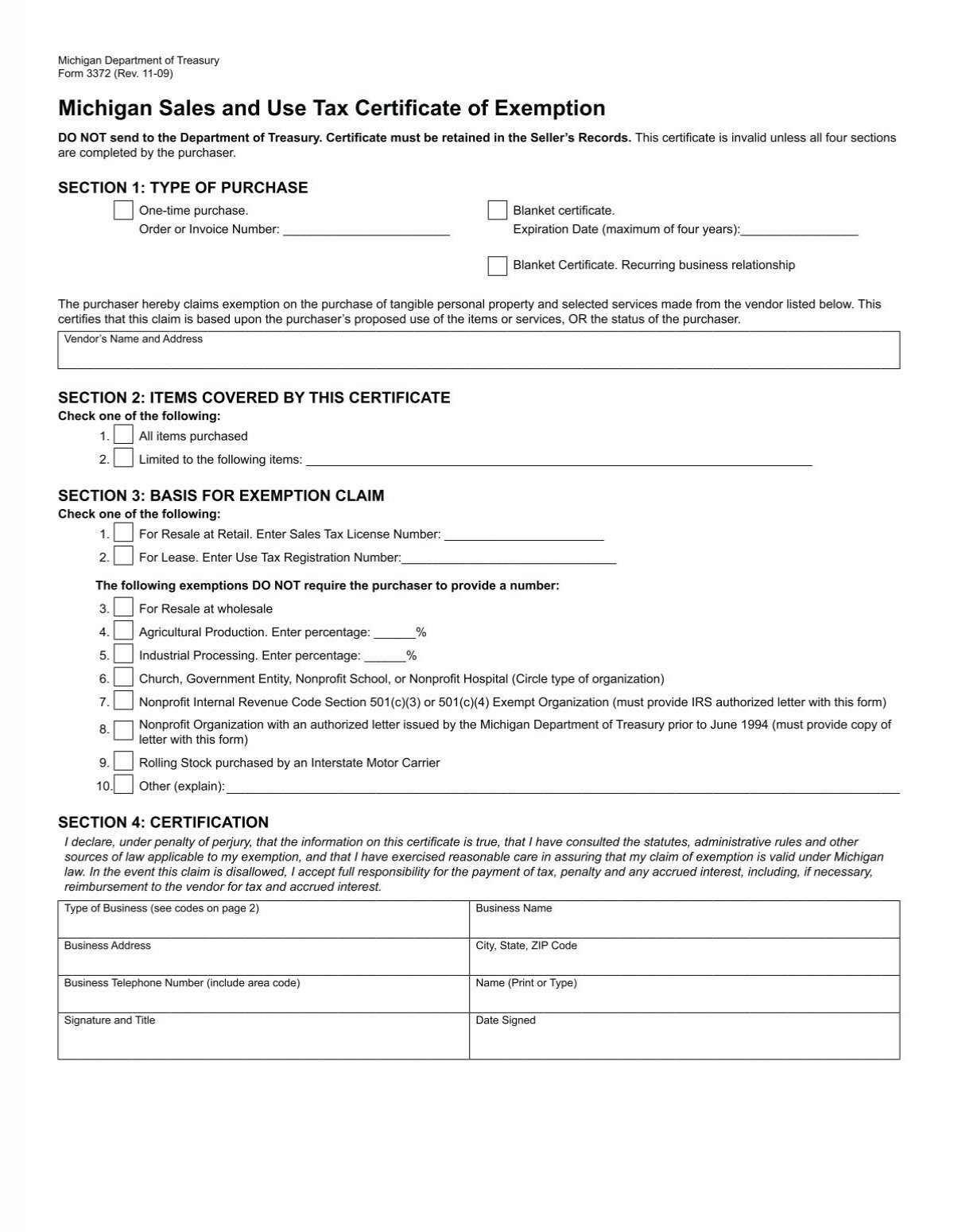

The exemption certificate is 3372 Michigan Sales and Use Tax Certificate of Exemption. Sales of raw materials are exempt from the sales tax in Michigan. If you would like to file for Tax Exempt status please complete the following form we will update your tax status upon receipt of certificate.

Michigan case law has long held that a three-factor test is applicable in determining whether property remains tangible personal property or becomes part of the realty. MCL 2119o and 2 Eligible Manufacturing Personal Property Exemption MCL 2119m and MCL 2119n. These exempt sales must not involve property used in commercial enterprises.

Michigan defines industrial processing as the activity of converting or conditioning tangible personal property by changing the form composition quality combination or character of property for ultimate sale at retail or for use in the manufacturing of a product. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. The GSTA and UTA generally define industrial processing as the activity of converting or conditioning tangible personal property by changing the form.

Michigan offers an exemption from state sales tax on the purchase of electricity natural gas and water used in qualifying production activities. Any lease payments due after June 30 2030 will be subject to the full sales and use tax rate even if the lease began during the. 20 rows Sales Tax Exemptions in Michigan.

This exemption claim should be completed by the purchaser provided to the seller and is not valid unless the information in all four sections. Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520. Manufacturers and industrial processors with facilities located in Michigan may be eligible for a utility tax exemption.

The State of Michigan allows an industrial processing IP exemption from sales and use tax. To claim the Wisconsin sales tax exemption for manufacturing qualifying manufacturers need to complete Wisconsin Form S-211 which is a Wisconsin Sales and Use Tax Exemption Certificate and provide a copy of this certificate to their vendorsWisconsin has made it easy for qualifying manufacturers to complete the S-211 exemption certificate by providing. Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller certain types of equipment which is used in the agricultural business or some types of industrial machinery.

To learn more see a full list of taxable and tax-exempt items in Michigan. Sales of machinery are exempt from the sales tax in Michigan. Churches Sales to organized churches or houses of religious worship are exempt from sales tax.

Personal protective equipment PPE or safety equipment purchased by an individual engaged in industrial processing activity is considered exempt from Michigan sales and use tax so long as the equipment is used in industrial processing activities. Its important to note that this now applies to employee purchases and not just the exempt entity. Michigan Utility Sales Tax Exemption Michigan allows businesses to claim an exemption on the portion of their utility used in industrial processing which includes but is not limited to production or assembly research development engineering re-manufacturing and storage of.

For Resale at Wholesale. The Michigan sales and use tax exemptions for both the agricultural industry and the industrial processing or manufacturing industry include such language. In Michigan certain items may be exempt from the.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Michigans use tax rate is six percent. The exemption does not include tangible personal property.

Church Government Entity Nonprot School or Nonprot Hospital Circle type of organization. Manufacturing businesses pursuing a sales tax exemption from Bay City Electric should complete Form 3372 and submit to. Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing.

All claims are subject to audit. The following exemptions DO NOT require the purchaser to provide a number. The General Property Tax Act provides for exemptions for certain categories of personal property including.

City of Bay City Accounts Receivable Department 301 Washington Avenue Bay City MI 48708. The industrial processing exemption is limited to specific property and activities. This tax exemption is authorized by MCL 20554t 1 a.

This link will provide information on each of these exemptions including determining eligibility and how to claim the exemption. Small Business Taxpayer Exemption Eligible Manufacturing Personal Property and Act 328 New Personal Property. The claimant generally provides an exemption certificate to the supplier of the utility showing the amount that is exempt.

Sales of utilities fuel are exempt from the sales tax in Michigan. For example a restaurant may claim an exemption on the purchase of an oven or a mixer directly used in baking or mixing. 6 A person processing food for sale is a manufacturer and may claim a sales or use tax exemption on purchases of equipment and other taxable items that qualify for exemption under Tax Code 151318.

In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer. 01-21 Michigan Sales and Use Tax Certificate of Exemption. Do not send a copy to Treasury unless one is requested.

Michigan Department of Treasury 3372 Rev. This tax will be remitted to the state on monthly quarterly or annual returns as required by the Department. Michigan provides an exemption from sales or use tax on machinery or equipment used in industrial processing and in their repair and maintenance.

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption For Manufacturing

Sales And Use Tax Regulations Article 3

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption For Manufacturing

Mi Sales Tax Exemption Form Animart

Download Policy Brief Template 40 Brief Policies Ms Word

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption