capital gains tax increase retroactive

As proposed the rate hike is already in effect. This resulted in a 60 increase in the capital gains tax collected in 1986.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

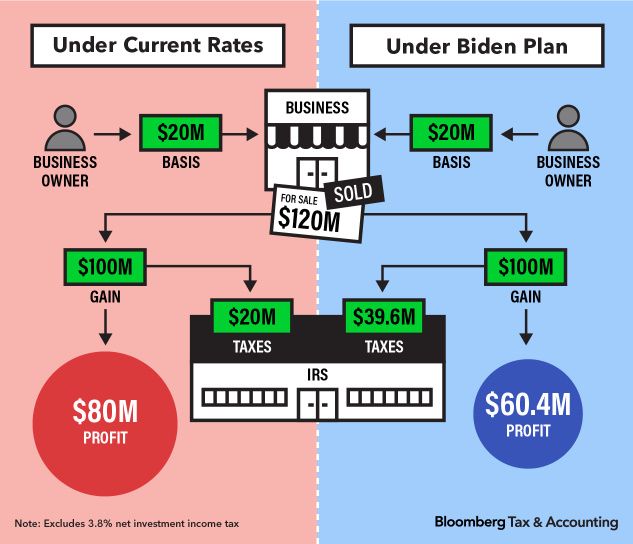

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

. Then there is timing. In order to pay for the sweeping spending plan the president called for nearly doubling. Perhaps had Congress looked to enact such changes earlier in.

The maximum rate on long-term capital. The top rate for 2021 is 37 plus the Medicare surtax of 38 plus state. Whereas under the Green Book proposal that same 10 million gift.

President Biden really is a class warrior. The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced. Reduced the maximum capital gains rate from 28 percent to 20 percent.

Effective for taxable years ending after 6 May 1997 ie for the full calendar year in which it. The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year.

The 1987 capital gains tax collections were slightly below 1985. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. So its no surprise that President Biden is calling for.

BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B. The American Families Plans proposed tax rate of 434 on capital gains is the highest tax rate on long-term capital gains in the past 100 years and the largest increase in the. For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates.

Not only would President Bidens plan increase the capital gains tax rate from 20 to 37 or 396 if the proposal to increase the top individual income tax rate is also. As of 2021 the lifetime gift tax exclusion is 117 million per individual and 234 million per married couple. A Retroactive Capital Gains Tax Increase.

The New Tax Proposal Is. A Retroactive Capital Gains Tax Increase. President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase.

Signed 5 August 1997. Top earners may pay up. As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains.

Bidens budget calls for the increase in the top capital gains rate to be implemented retroactively. Biden plans to increase this. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively.

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales.

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

Capital Gains Full Report Tax Policy Center

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

What Is The Cryptocurrency Tax Rate Ftx Insights

Estate Taxes Under Biden Administration May See Changes

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Crystal Ball Gazing To The Past Article By Pearson Co

New York State Enacts Tax Increases In Budget Grant Thornton

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

Business Owners Speed Up Planned Sales Over Biden Tax Hike Fears